Indicators are a vital component of trading, providing actionable insights into market trends, momentum, and potential reversals. On TradingView Charts, indicators come to life with advanced functionality, customization, and ease of use. To unlock their full potential, traders need a strategic approach to selecting, applying, and interpreting these powerful tools.

Choosing the Right Indicators for Your Strategy

Not all indicators are created equal, and selecting the right ones depends on your trading style and goals. TradingView Charts offer hundreds of built-in indicators, from the simple Moving Average to more complex ones like Bollinger Bands and Ichimoku Clouds. To avoid clutter and confusion, it’s essential to choose indicators that complement each other without redundancy.

For example:

- Trend-following traders might rely on Moving Averages or the MACD to confirm the direction of the market.

- Momentum traders could use the RSI or Stochastic Oscillator to identify overbought or oversold conditions.

- Volatility-based traders might turn to Bollinger Bands or the ATR (Average True Range) to measure price fluctuations.

A good rule of thumb is to use one indicator for trend analysis, one for momentum, and one for volatility to create a well-rounded perspective.

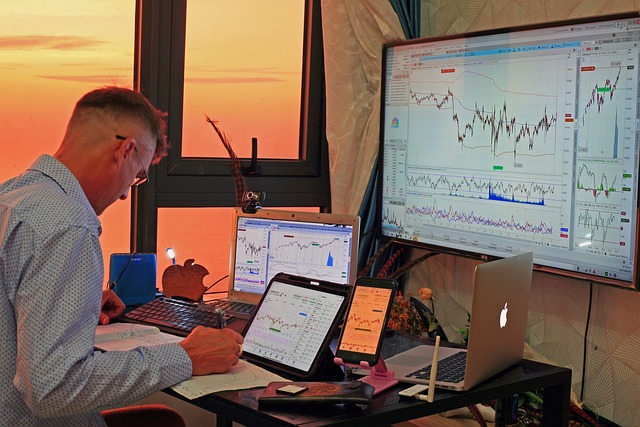

Layering Indicators Without Overloading

One of the common mistakes traders make is overloading their charts with too many indicators, leading to conflicting signals and analysis paralysis. On TradingView Charts, you can avoid this by strategically layering indicators that work together harmoniously.

For instance:

- Combine a Moving Average with the RSI to track both trend and momentum.

- Use Bollinger Bands alongside volume indicators to confirm breakout strength.

TradingView makes it easy to adjust settings and colors for each indicator, ensuring a clean, uncluttered chart that enhances your decision-making.

Customizing Indicators to Fit Your Needs

Default settings don’t always suit every market or trading style. TradingView Charts allow you to tweak indicator parameters for optimal performance. For example:

- Adjust the period length on a Moving Average to align with your trading timeframe.

- Modify the RSI’s overbought and oversold levels (e.g., 80 and 20 instead of 70 and 30) for more precise signals in volatile markets.

This flexibility ensures your indicators are tailored to the assets and timeframes you trade, improving their effectiveness.

Combining Indicators with Drawing Tools

Indicators are most effective when used in conjunction with technical drawing tools. On TradingView Charts, you can use trendlines, Fibonacci retracements, or support and resistance levels alongside indicators to confirm signals.

For example:

- A trendline breakout coupled with an RSI divergence strengthens the case for a potential reversal.

- A Bollinger Band squeeze near a key resistance level might signal an impending breakout.

This holistic approach ensures your analysis is both technical and visual, enhancing confidence in your trades.

Setting Up Alerts for Key Indicator Signals

Monitoring charts 24/7 isn’t practical, which is where TradingView’s alert system comes into play. You can set alerts for specific indicator signals, such as:

- RSI crossing into overbought/oversold territory.

- MACD lines crossing for a potential trend shift.

- Price breaking above or below Bollinger Bands.

With these alerts, you’ll never miss critical market movements, even when you’re away from your screen.

The Key to Indicator Success

Indicators are powerful, but they’re not magic. Their true value lies in how you interpret and apply them within the context of broader market analysis. With TradingView Charts, you have the tools to not only use indicators effectively but also integrate them into a comprehensive trading plan.

By focusing on the right indicators, customizing settings, and combining them with other analytical tools, you can transform your charts into a powerful decision-making framework. Whether you’re trading stocks, forex, or cryptocurrencies, TradingView’s advanced indicator features ensure you’re equipped to navigate any market with confidence.